Making healthcare coverage available to employees is one thing. Making care truly accessible is quite another.

Makes basic care affordable

This plan includes four free visits to make it even easier for your employees to see the doctors and specialists they need and get the care that’s most important to their health.

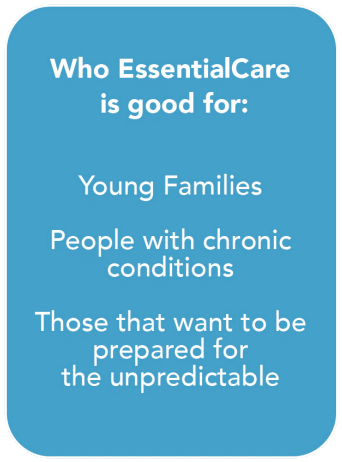

EssentialCare

| Commonly used benefits | ||

Commonly used benefits |

Primary care office visits | First 4 visits $0 then co-pay or deductible + coinsurance* |

| Specialist office visits | First 4 visits $0 then co-pay or deductible + coinsurance* |

|

| Mental health office visits | First 4 visits $0 then co-pay or deductible + coinsurance* |

|

| Retail clinics | First 4 visits $0 then co-pay or deductible + coinsurance* |

|

| Urgent care | First 4 visits $0 then co-pay or deductible + coinsurance* |

|

| Habilitative & rehabilitative therapies |

First 4 visits $0 then co-pay or deductible + coinsurance* |

|

| Virtual primary care and urgent care visits through CirrusMD |

$0 | |

| Common maintenance labs | $0 | |

| Common maintenance medications | $5 for a 30-day supply | |

All other services such as emergency room, outpatient surgery, or inpatient hospital stays are subject to the deductible and coinsurance. Retail clinics are healthcare facilities typically located within retail stores, pharmacies, or supermarkets. Copay or coinsurance will vary by plan.

Coverage Includes:

certified clinicians, available 24/7 through CirrusMD |

|

EssentialCare is a level-funded plan.

Our level-funded plans include administrative services provided by TXM Holdings LLC dba Texicare and its partners. Stop-loss insurance is underwritten by Texicare Health Insurance Company, licensed in Texas.